Budgeting for demand generation and growth is a critical aspect of any business’s success. It involves allocating financial resources strategically to fuel marketing efforts, expand operations, and drive revenue. In this guide, we’ll explore how to properly budget for demand generation and growth, considering key factors, steps, and best practices.

Before creating a budget, establish clear, measurable objectives for your demand generation and growth efforts. Define your goals, such as increasing revenue by a specific percentage, expanding into new markets, or launching new products. Objectives provide a roadmap for budget allocation.

Evaluate your current performance, including past marketing campaigns, sales data, and operational efficiency. Identify areas where improvements are needed and where additional investment can make the most impact.

Stay informed about market and industry trends to make informed budgeting decisions. Market research helps you understand customer preferences, competitive landscapes, and emerging opportunities.

Assess your financial resources, taking into account existing cash flow, reserves, and access to financing. Your budget should align with the funds you have available or plan to secure.

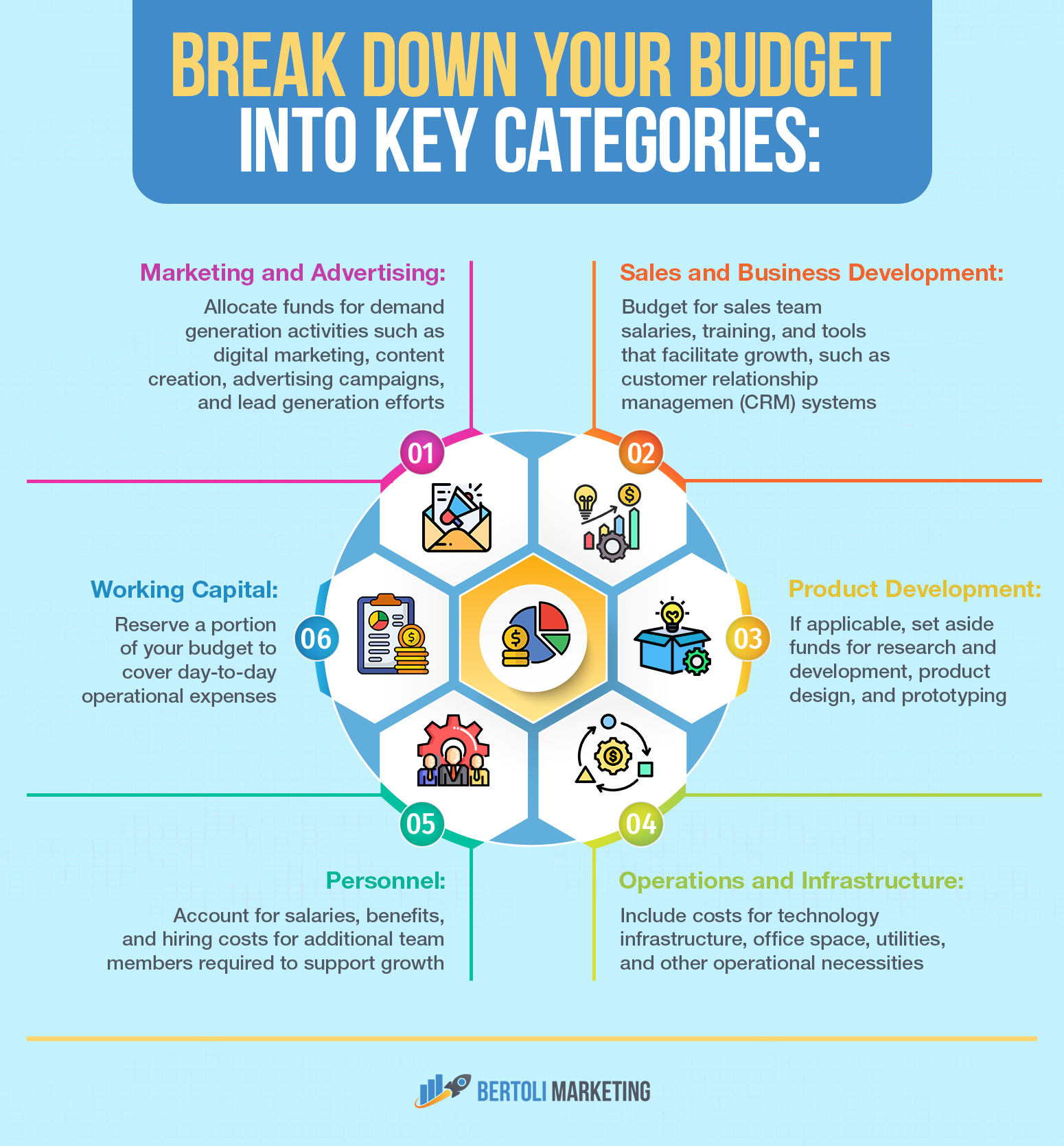

Break down your budget into key categories:

Not all budget categories require equal investment. Prioritize areas that align with your growth objectives. For instance, if your goal is to expand market reach, allocate a significant portion to marketing and advertising.

Every budget decision should consider potential return on investment (ROI). Determine the key performance indicators (KPIs) that will measure the success of your growth initiatives. Budget for tools and resources to track and analyze these metrics.

Set aside a contingency fund to address unforeseen challenges or opportunities. Having flexibility in your budget allows you to adapt to changing market conditions.

Budgeting is not a one-time task; it’s an ongoing process. Regularly review your budget, assess performance against objectives and adjust allocation as needed. Be agile in responding to changes in your industry or market.

Whenever possible, invest in solutions and technologies that can scale with your growth. Scalable marketing tools, cloud-based infrastructure, and adaptable business processes can help you avoid frequent budget overhauls.

Implement expense monitoring and control mechanisms to prevent overspending. Use financial software or tools to track expenditures and ensure alignment with your budget.

Consider consulting with financial experts or advisors who specialize in budgeting and financial planning. Their insights can help you make informed decisions.

Don’t be afraid to experiment with different strategies within your budget. Test new marketing channels, sales approaches, or product features, and use data to iterate and refine your strategies.

Utilize data analytics tools to gather insights into customer behavior, marketing campaign performance, and sales metrics. Data-driven decision-making can help you allocate your budget more effectively.

Establish realistic timelines for achieving your growth objectives. Understand that some initiatives may take time to yield results, so be patient and stay committed to your long-term goals.

Allocate a portion of your budget to training and development programs for your employees. Well-trained staff can drive growth by improving efficiency and customer satisfaction.

Encourage innovation within your organization. Budget for innovation initiatives, research and development, and experimentation to stay competitive and adapt to evolving market trends.

Consider forming partnerships or collaborations that can help you expand your reach and resources without significant upfront costs. These alliances can be mutually beneficial for growth.

Study your competitors’ growth strategies and budgets. Analyze what has worked for them and adapt successful elements to your own plan.

Share your budget plan and objectives with key stakeholders, including your team, investors, and partners. Ensuring alignment and understanding can lead to better cooperation and support.

Include a risk management strategy within your budget. Identify potential risks and allocate funds to mitigate or respond to unexpected challenges.

Allocate resources for gathering customer feedback and conducting market research. Understanding your customers’ needs and preferences can drive more effective demand generation efforts.

Emphasize the importance of ongoing budget reviews and adjustments. Market conditions and business dynamics can change rapidly, requiring your budget to evolve accordingly.

Acknowledge and celebrate milestones and achievements along the way. Recognizing progress can boost morale and motivation among your team.

While focused on growth, keep long-term sustainability in mind. Avoid budget decisions that prioritize short-term gains at the expense of long-term stability.

Maintain an emergency fund within your budget for unexpected financial setbacks or opportunities. Having reserves can provide a safety net during uncertain times.

Consult with tax experts to understand the tax implications of your budget decisions. Effective tax planning can optimize your financial resources.

Keep records of your budget decisions and their outcomes. Review past budgets and learn from successes and failures to continuously improve your budgeting process.

Zero-based budgeting is a method where you start each budgeting cycle from scratch, justifying every expense from the ground up. This approach can help identify areas of inefficiency and prioritize spending based on current needs.

Invest in financial software and automation tools that can streamline budgeting processes, track expenses in real-time, and provide insights into financial performance.

Agile budgeting is a flexible approach that allows for adjustments throughout the budget cycle. It’s particularly useful when dealing with rapidly changing markets or industries.

Segment your budget into fixed and variable costs. Fixed costs are stable and recurring, while variable costs fluctuate with sales or production levels. This segmentation helps you better manage expenses.

In addition to traditional financing, consider alternative options such as venture capital, angel investors, crowdfunding, or strategic partnerships to secure funding for growth initiatives.

Develop and track KPIs that directly tie budget expenditures to specific performance metrics. This helps you assess the effectiveness of your spending.

Create multiple budget scenarios to prepare for different economic conditions or market disruptions. Scenario planning helps you anticipate and react to various situations.

Allocate a portion of your budget to diversify your marketing channels. Experiment with various online and offline channels to reach a broader audience and reduce dependency on a single channel.

Keep a close eye on your customer acquisition costs and ensure they remain within acceptable levels. Adjust your marketing strategies or budgets if CAC becomes unsustainable.

Allocate funds for ongoing training and skill development for your team. Well-trained employees are more effective in driving growth.

Regularly review supplier contracts to identify cost-saving opportunities, negotiate better terms, or explore alternative suppliers.

Stay updated on government tax incentives or grants that can benefit your business. These incentives may provide financial support for specific growth activities.

Include capital expenditures in your budget for significant investments like equipment, technology, or facility expansion. Ensure these investments align with your growth strategy.

Utilize predictive analytics to forecast future revenues, expenses, and market trends. This data-driven approach can enhance the accuracy of your budgeting process.

Establish a reserve fund to cover unexpected expenses or take advantage of growth opportunities. A reserve fund adds a layer of financial security to your budget.

Consider consulting with financial advisors or experts who specialize in budgeting for growth. They can provide valuable insights and strategies tailored to your specific industry and business needs.

Encourage employees at all levels to contribute to cost-conscious practices within the organization. When everyone is mindful of expenses, it can lead to cost savings.

If your growth plan includes expanding into international markets, budget for market research, legal compliance, currency exchange considerations, and localization efforts.

Consider adopting a rolling forecast approach where you regularly update your budget based on actual performance. This real-time adjustment can help you stay agile and responsive to changes.

For businesses with inventory, efficient inventory management can free up working capital. Invest in inventory tracking systems and practices to minimize carrying costs.

Allocate resources to customer retention initiatives. It’s often more cost-effective to retain existing customers than to acquire new ones.

Continuously evaluate the ROI of various growth initiatives. Allocate more budget to strategies and channels that demonstrate the highest ROI.

Recognize that economic cycles, including recessions, can impact your business. Include contingency plans in your budget for economic downturns.

Before investing in new technologies or infrastructure, assess their scalability. Ensure that these investments can accommodate future growth without major overhauls.

Evaluate the potential benefits of debt financing for growth projects. While it carries risks, it can provide the capital needed for significant expansion.

Continuously monitor and analyze your competitors’ strategies and budgets. This competitive intelligence can inform your own budget decisions.

Implement lean budgeting practices to eliminate waste and allocate resources more efficiently. Identify non-essential expenses and cut them from the budget.

Budget for initiatives that enhance the overall customer experience. Satisfied customers are more likely to become loyal advocates and contribute to sustainable growth.

If your business relies on intellectual property, budget for protecting and enforcing your IP rights. This safeguards your unique assets and competitive advantages.

Explore collaborative efforts with industry partners, suppliers, or complementary businesses. Joint ventures or co-marketing initiatives can expand your reach without a substantial budget increase.

Conduct thorough cost-benefit analyses for major projects or investments. Ensure that potential benefits outweigh the associated costs.

Stay informed about changes in laws and regulations that could impact your industry. Budget for compliance and adjustments as needed.

If sustainability is part of your growth strategy, allocate budget for eco-friendly practices, renewable energy adoption, and environmentally responsible product development.

Protect your intellectual property through patents, trademarks, or copyrights. Budget for legal fees and registrations as part of your growth strategy.

As your business grows, invest in robust data security measures to protect customer information and maintain trust.

Allocate resources for digital transformation initiatives, such as e-commerce platforms, mobile apps, or AI-driven technologies, to stay competitive in the digital age.

Ensure you have a robust business continuity plan in place. Budget for disaster recovery and continuity measures to safeguard against unexpected disruptions.

Background:

HubSpot, a leading inbound marketing and sales software company, provides tools for businesses to attract, engage, and delight customers. Their growth strategy heavily relies on inbound marketing.

Budgeting Strategy:

HubSpot allocated a significant portion of its budget to inbound marketing efforts, including content creation, social media, and search engine optimization. They prioritized content marketing, producing valuable blog posts, e-books, and webinars to attract leads and build authority in their industry.

Results:

HubSpot’s inbound marketing strategy helped them generate over 75,000 leads per month.

Their approach to budgeting for content creation and distribution resulted in a 400% increase in blog traffic.

By focusing on lead nurturing and conversions, they achieved substantial revenue growth, making them a market leader in the marketing automation industry.

Lesson Learned:

HubSpot’s case demonstrates the effectiveness of aligning budgeting with a specific growth strategy. By investing in inbound marketing, they attracted and converted leads, ultimately driving substantial business growth.

Background:

Airbnb, a global online marketplace for lodging and travel experiences, pursued an aggressive international expansion strategy to grow its user base and revenue.

Budgeting Strategy:

Airbnb allocated a substantial portion of its budget to international expansion efforts. This included entering new markets, localizing its platform, and marketing to potential hosts and guests in those regions.

Results:

Airbnb successfully expanded to over 220 countries and regions, becoming a global brand.

Their investment in localizing their platform and tailoring marketing efforts to specific regions contributed to rapid growth in bookings.

International expansion drove significant revenue growth, allowing Airbnb to compete with traditional hotel chains.

Lesson Learned:

Airbnb’s case highlights the importance of budgeting for expansion when pursuing a growth strategy. By dedicating resources to enter and grow in new markets, they achieved remarkable success on a global scale.

Background:

Slack, a popular messaging platform for teams, aimed to rapidly acquire users and establish itself as a dominant player in the workplace communication market.

Budgeting Strategy:

Slack adopted a growth-focused budgeting strategy that heavily invested in user acquisition. They allocated resources to marketing campaigns, partnerships, and product enhancements that would attract and retain users.

Results:

Slack’s user acquisition efforts were highly successful, with millions of users adopting the platform within a short timeframe.

Their strategic budgeting allowed them to expand their user base in various industries, from startups to Fortune 500 companies.

Slack’s focus on user experience and continuous improvement contributed to widespread adoption and helped them become a market leader.

Lesson Learned:

Slack’s case underscores the importance of allocating budget resources to activities that directly contribute to user acquisition and retention when pursuing rapid growth in a competitive market.

Background:

Tesla, an electric vehicle and clean energy company, aimed to revolutionize the automotive industry by producing electric cars with mass-market appeal.

Budgeting Strategy:

Tesla allocated a substantial portion of its budget to research and development (R&D) and innovation. They invested in the development of electric vehicle technology, battery manufacturing, and autonomous driving systems.

Results:

Tesla’s innovative approach to budgeting led to the production of groundbreaking electric vehicles like the Model S and Model 3.

Their investment in battery technology and manufacturing efficiency contributed to the success of the Tesla Gigafactories.

Tesla’s growth strategy included expanding into new markets and segments, such as energy storage and solar energy products.

Lesson Learned:

Tesla’s case highlights the importance of strategic budgeting for innovation and expansion. By dedicating substantial resources to R&D and technological advancements, they disrupted the automotive industry and expanded their product offerings beyond cars.

Background:

Amazon, one of the world’s largest e-commerce and technology companies, sought to expand its market presence globally while maintaining its customer-centric approach.

Budgeting Strategy:

Amazon allocated a significant portion of its budget to customer acquisition and retention. They invested in logistics, distribution centers, and technology to improve the customer experience. Additionally, they expanded their product and service offerings through acquisitions like Whole Foods and investments in AWS (Amazon Web Services).

Results:

Amazon’s customer-focused approach led to impressive customer loyalty and retention, making it a dominant player in online retail.

Their investments in logistics and fulfillment allowed them to offer fast and reliable shipping services, further enhancing the customer experience.

Diversification into cloud computing (AWS) and the grocery industry (Whole Foods) contributed to robust revenue growth.

Lesson Learned:

Amazon’s case emphasizes the significance of customer-centric budgeting when pursuing market expansion. Investments in infrastructure, technology, and customer service are essential for long-term growth and customer retention.

Background:

Netflix, a global streaming entertainment service, aimed to expand its subscriber base and become the world’s leading content provider.

Budgeting Strategy:

Netflix allocated a substantial portion of its budget to content creation and acquisition. They invested in producing original content, securing licensing deals, and expanding their global content library.

Results:

Netflix’s focus on content led to the creation of critically acclaimed original series and movies, attracting a large and loyal subscriber base.

Their global expansion strategy, entering new markets and offering localized content, significantly increased their international subscriber count.

Netflix’s budgeting for content allowed them to compete successfully with traditional cable and satellite TV providers.

Lesson Learned:

Netflix’s case demonstrates the power of budgeting for content creation and global expansion in the entertainment industry. Investment in high-quality, exclusive content can drive subscriber growth and brand loyalty.

Background:

McDonald’s, one of the world’s largest fast-food chains, embarked on a digital transformation journey to enhance customer experiences and drive growth in the digital age.

Budgeting Strategy:

McDonald’s allocated a substantial portion of its budget to digital initiatives. They invested in technology infrastructure, mobile app development, and digital ordering and payment systems. Additionally, they focused on data analytics to personalize customer experiences and improve menu offerings.

Results:

McDonald’s digital ordering and payment systems, combined with mobile app promotions, significantly boosted online orders and customer engagement.

Their investment in data analytics allowed for personalized marketing campaigns, leading to increased customer loyalty and higher average order values.

The digital transformation strategy contributed to revenue growth and positioned McDonald’s as a leader in the fast-food industry’s digital space.

Lesson Learned:

McDonald’s case underscores the importance of budgeting for digital transformation when seeking to adapt to changing consumer behaviors and preferences. Investment in technology and data-driven strategies can drive growth and competitive advantage.

Background:

In 2020, the COVID-19 pandemic severely impacted the travel and hospitality industry. Airbnb faced a unique challenge of adapting to the crisis and planning for recovery.

Budgeting Strategy:

Airbnb adjusted its budget to align with the crisis situation. They reduced marketing expenses, paused hiring, and reallocated resources to prioritize customer support and safety measures. Additionally, they focused on supporting their host community during the crisis.

Results:

Airbnb’s crisis management strategy allowed them to quickly respond to changing traveler needs and safety concerns, positioning them as a trusted platform.

The reallocation of budget resources helped Airbnb navigate the financial challenges posed by the pandemic while supporting hosts and maintaining their ecosystem.

As travel began to recover, Airbnb gradually increased marketing spending to capture pent-up demand.

Lesson Learned:

Airbnb’s case demonstrates the importance of agile budgeting during crises. Adaptability, resource reallocation, and a focus on customer safety and support are crucial elements for businesses facing unforeseen challenges.

These case studies highlight the versatility of budgeting strategies in response to various business objectives and external factors. Whether it’s digital transformation, crisis management, or adapting to changing consumer behaviors, effective budget allocation plays a pivotal role in achieving growth and resilience. Businesses should assess their unique circumstances and goals to develop budgeting strategies that align with their long-term vision and market dynamics.

Our mission is to help battery and energy industry companies quickly and effectively reach their revenue goals.

We’ll provide you with a complimentary digital marketing audit so that you can quickly learn how to optimize your digital presence. Just fill out the form below: